The supply chain crunch and inflation are compounding whats already a nettlesome recovery for hotel owners and operators.

NB: This is a short article from HotStats

” While we can push the envelope with space pricing, there are fixed parts of our organization– such as parking, resort fees and retail– that you cant reprice,” said Chris Cylke, COO of possession supervisor RevPAR International.

Though hotels use nighttime leases, enabling for the repricing of rooms on a dynamic basis, other revenue-generating outlets are more intransigent– a problem when inflation is skyrocketing.

Register for our weekly newsletter and keep up to date

Cylke counsels hotels to secure multiple vendors for an item instead of simply one. “Updating your vendor lists a couple of times a year is a good concept to guarantee you are still getting the very best prices as some products are seeing price changes daily,” he stated.

In its asset management capacity, to keep costs down JLL is restoring features and services on a rolling basis to its residential or commercial properties that stopped throughout the pandemic, such as in-room coffee makers and day spa treatments, and its revamping its budgeting process, Grigg said.

Its producing a headache for budget preparation, too.

Concurrent supply chain concerns affecting OS&E and FF&E and per hour incomes increasing are taking a toll on fundamental operational performance.

As the market recovers, food and beverage costs are inching up. On a per-available-room basis in the U.S., for circumstances, overall F&B costs, inclusive of labor, expense of sales and other costs, rose to $27.65 in September 2021, up from $11.80 at the very same time a year ago, however $24.42 lower than in September 2019, according to HotStats data.

” This is a phenomenal opportunity for the industry to deal with zero-based budgets [which begin with absolutely no, rather of the previous years numbers, in order to dig deep in examining requirements] so we can focus on what services visitors truly value. Were collaborating more with the hotels due to the fact that many things require to be rethought.”

” Looking at budget plans for 2022, its rather concrete where inflation is impacting our organization design,” stated Andrea Grigg, Senior Managing Director, Head of Global Hotel Asset Management, JLL Hotels & & Hospitality. “On a per-occupied-room basis, we are forecasting prices in 2022 to be up 8% to 11.5% for guestroom linens and 6% to 8% for features over 2019,” and the list goes on.

Grigg sees the requirement to revamp prices much more broadly. “Strategic incremental profits growth can be attained through the implementation of nontraditional variable pricing on food, drink and parking and retail outlets,” she said.

It might feel like the deck is stacked versus hoteliers, there are steps that can be taken to remedy the issues. For example, Cylke recommends asking providers whats readily offered, adjusting part options and deploying dynamic rates to manage rising food and drink costs. The latter step “isnt the industry norm,” he acknowledged, “however its something we most likely ought to be looking at more frequently.”

Supply Chain Headache

Added Cylke, “There needs to be communication and an understanding of practical timelines. Interior designers, FF&E producers and the like requirement to communicate with task supervisors and hotel asset supervisors on sensible timelines for shipment, and then the project and property manager require to enhance scheduling so the work does not hinder organization.”

Handling the supply chain problem is even more complex. The scarcities originate from a confluence of issues, stated Darlene Henke, President and CEO of Audit Logistics.

To alleviate both inflation and supply issues, Grigg recommends hotels to carefully handle expenses. “Every cent you conserve is very essential. Comprehending the flow through of every dollar is the essential to hotel profit maximization,” she said.

Henke encourages hoteliers to prepare for hold-ups. “Our advice is to keep moving on [on remodellings or new builds] You have to change schedules. What used to have an 18- to 20-week preparation will now take in between 32 and 38 weeks,” she stated.

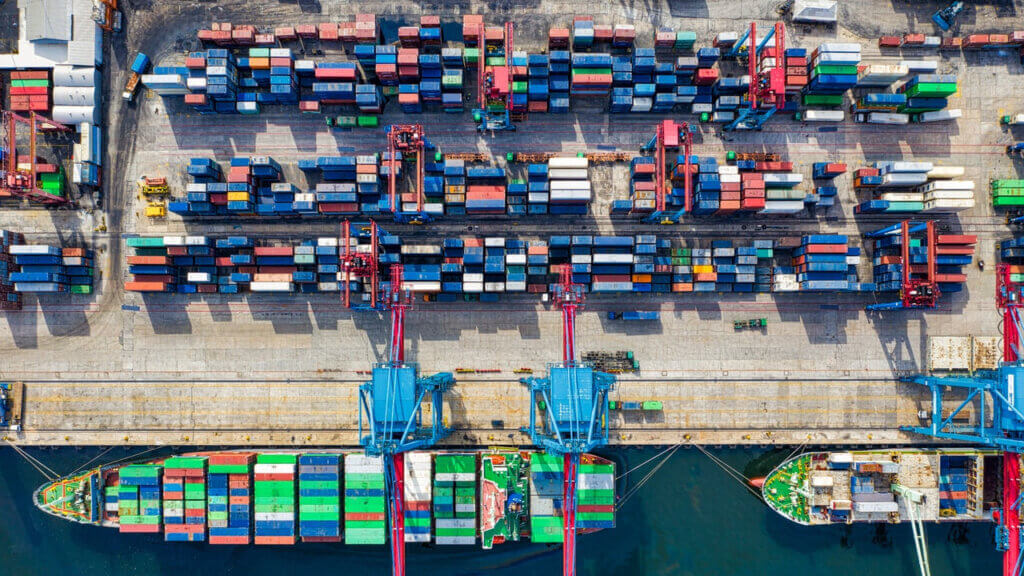

Shutdowns of factories throughout Asia in 2015 dovetailed with increased need worldwide for big items, such as workout equipment and furniture, as more people worked from home, producing massive shipments, Henke stated Meanwhile, the labor shortage is preventing the products from being unloaded at the ports.

Read more short articles from HotStats

What used to have an 18- to 20-week lead time will now take between 32 and 38 weeks,” she stated.

It might feel like the deck is stacked versus hoteliers, there are steps that can be taken to fix the problems. Cylke advises asking providers whats readily offered, changing part options and releasing dynamic rates to cope with rising food and beverage expenses. Were working together more with the hotels due to the fact that lots of things need to be rethought.”

To mitigate both inflation and supply concerns, Grigg advises hotels to carefully manage expenses.