Operators are focusing on Shaftesburys thoroughly curated, high profile villages, as step continues to increase and retail and F&B spending bounces back. Data from CACI and Location Sciences shows Shaftesburys areas are outshining the wider West End, where the volumes of people are currently at 72% of pre-Covid levels. CACI and Location Sciences have actually been tracking volumes of individuals in major UK cities and towns on a weekly basis given that the start of the pandemic utilizing data collected anonymously from a variety of smartphone apps.

This round-up of Shaftesburys retail and hospitality leasing since 1 October 2020 follows the announcement of its 2021 annual results. Published on 30 November, they reported substantial development on the road to healing for its 16-acre West End portfolio, that includes over 600 restaurants, shops, bars, clubs and cafes, throughout 1.1 million sq. ft. of space.

[1] CACI and Location Sciences have actually been tracking volumes of individuals in significant UK cities and towns on a weekly basis given that the beginning of the pandemic using information collected anonymously from a series of smartphone apps.

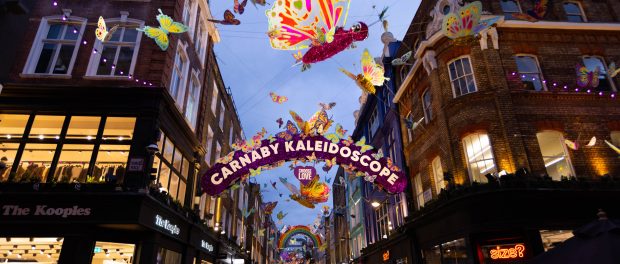

Shaftesbury has actually announced it has actually transferred 60 new retail, hospitality and leisure brands in Carnaby, Seven Dials, Chinatown, Soho and Fitzrovia since 1 October 2020. The strength of demand from operators also coincides with the rapid recovery in tramp and sales throughout its areas and represents a vote of self-confidence in their long-lasting appeal and potential customers.

33 brand-new merchants have signed up with Shaftesburys towns, of which 23 were brand names making their debuts in the UK, consisting of six from the US: LIDS, NBA, American Eagle and Aerie, Third Man Records and Gilly Hicks. Of the launchings, 9 were online brand names opening their very first bricks-and-mortar stores,.

Matching the brand-new retail brands, 29 F&B operators throughout 18 different cuisines or fusions have actually signed and opened in Shaftesburys portfolio. In addition, 3 of the brand-new places are bars or live music focused, consisting of Nightjar, a jazz bar in Kingly Court.

Operators are concentrating on Shaftesburys carefully curated, high profile towns, as tramp continues to rise and retail and F&B costs gets better. Weekend step is currently at or above 2019 levels, while weekdays are at approximately 80%. Data from CACI and Location Sciences indicates Shaftesburys areas are outshining the broader West End, where the volumes of people are currently at 72% of pre-Covid levels. [1]

Samantha Bain-Mollison, Retail Director, stated: “The level and quality of need for space from such great brands and principles shows the strength of our portfolio and speed of its healing following the lifting of pandemic limitations. The 33 brand-new merchants to have actually signed this year have actually added something different to our villages, enhancing their positions as exciting West End shopping locations and contributing to Londons status as a global city for retail.”