For numerous hotels, the line between “distribution” and “marketing” has actually constantly been rather blurry.

NB: This is an article from mirai, one of our Expert Partners

Incorrectly or not, commissions paid to OTAs have typically been considered a “distribution” expense, whereas its feasible that a huge piece of that is “marketing”. Oddly, “marketing” actions have actually generally been a separate line in the P&L called “marketing fees/investment” and have actually rarely been determined as “distribution” expenses, when they might have.

Sign up for our weekly newsletter and keep up to date

Why is Booking.com releasing native ads?

Income designs of OTAs and marketing platforms have not helped much either. On the one hand, OTAs work with commission designs, a concept that is deeply rooted in the hoteliers DNA as a “distribution” expense. On the other hand, marketing platforms such as Google generally work on CPC (cost per click) or CPM (expense per 1,000 impressions) designs that are paid upfront. For hotels, that is either a cost or an investment, however hardly ever a circulation cost.

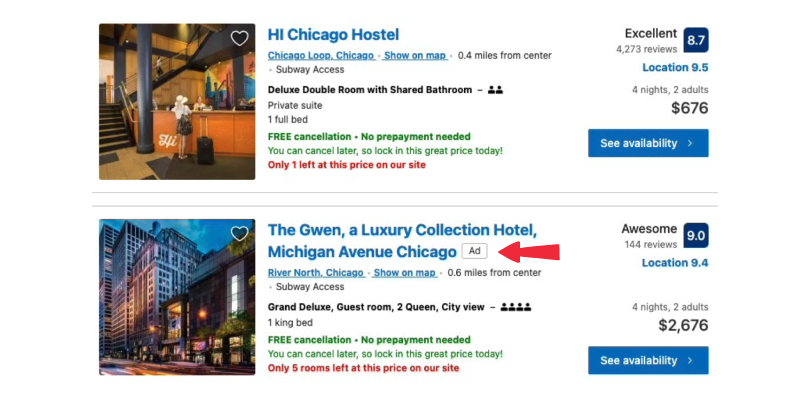

A few years earlier, Expedia released the TravelAds program intending to give hotels a “marketing tool” within a “circulation platform”. Booking.com now follows fit, with distinctions however, and presents native advertisements, a “marketing” program on top of their “circulation” platform.

A program that enables hotels to bid in a CPC design to improve their visibility in location searches. The winner of that quote gets direct access to the 2nd position in the results first page (not subsequent pages).

Rather than Expedia TravelAds where hotels can select whether to connect to their website (link off) or to stay in Expedia (link on), users in native ads will, up until now, remain in Booking.com. There is no alternative to connect to the hotels website in these ads.

What are Booking.com native advertisements?

A few factors:

The main objective is to tap into the growing marketing budget of hotels. To increase inbound income from commissions since hotels in native ads will most likely have greater ADRs than those ranked naturally. The challenge for Booking.com is to make this native ad as engaging as the original (organically) second position in the results.Keep improving their market by providing hotels more alternatives to increase their profits and return on Booking.com “financial investments”.

Where in the funnel do native advertisements contribute?

Native ads desire to play a “share shift” video game and not a “channel shift” one. From a hotelier viewpoint, incremental revenue, even through OTAs, is extremely appealing and 100% suitable with their direct channel methods.

This is probably the most interesting part, as native ads are mostly meant for location searches (” hotels in boston”) and not branded searches (” hotel four seasons boston”). So these advertisements contribute greater in the funnel, where incrementality takes location. OTAs have generally claimed it is more effective for hotels to capture presence high in the funnel within OTAs than in Google Ads.

How much do native advertisements cost? What multipliers does it provide?

Crucial to note that getting involved hotels can not adjust their quotes for Booking Genius users. In our view, this modifier is an essential for the program as the earnings for that sale is significantly lower than a typical booking.

Getting involved hotels set a “base quote” ($ 0.50 minimum, two times as much as the existing minimum bid in Expedia Travel Ads and 5x more than when Expedia first launched Travel Ads) based upon a travel window (weekends or weekdays 0-21 days or 22 days and beyond). Hotels have the option to set an optimal day-to-day invest starting at $5/daily.

Hotels have the choice to use multipliers or boosters on 3day+ or 6day+ lengths of stay (LoS), mobile gadget, check-in date for the next 0-48 hours, and kind of booking (organization, worldwide or group). The minimum incremental bid for the boosters is $0.25. So far, there is no booster for specific markets or audiences (online users with same interests or intents).

How can I register for Native Ads?

The program is still in a test phase and closed to a minimal number of hotels.

How does the quote to win native advertisements only positioning work?

How this algorithm works is still concealed by Booking.com, but we might guess that the bid will have an important impact. The OTA has a lot to lose if it just thinks about the bid. The second position in the outcomes is gold in regards to money making. Hotels that dont transform or dont produce a high revenue-per-click (low evaluation score, low conversion rate, etc.) will never ever be attractive for Booking.com, even if they pay a lot to be there.

One of the trickiest parts of native ads is that, so far, there is just one placement for all participants. Its true that there are numerous searches occurring daily on Booking.com, however only one placement seems inadequate. For that reason, we can expect high inflation to win the quote particularly in top destinations where many hotels would complete. On the other hand, Expedia TravelAds are displayed in much more positions (very first 1-5, some in the center 11-12 and the last 2 of each page). Its clear they have the program far more fine-tuned after more than a years of research testing various placements and page layouts.

How do native advertisements co-exist with the Preferred program, commission boosters and natural search?

When a getting involved hotel wins the quote and is already organically located very first or 2nd in the results, the advertisement is not shown (not even changed with another hotel). This is a wise distinction method by Booking.com, as native ads will be appealing in secondary locations where there are not that lots of hotels.

Native ads positioning has the second position scheduled, so hotels getting involved (and winning the bid) would bypass all other hotels (other than the very first position) even if these hotels participate in the Preferred program or are using commission boosters. Because method, its type of a “quick pass” option to be at the very leading. It is yet to be seen what average CPCs are needed to get good presence. How expensive can it become? Time will inform, but the best method ought to be from a success point of view and not a mere cost point of view.

Can the “include imagination” be personalized?

Advertisement copy is not adjustable at this moment. We d anticipate some modification, special callouts or other functions in future versions of the program.

Do native ads alter when filtering outcomes? And arranging?

Are Booking.com Native ads offered worldwide?

When a user filters the outcomes, the ranking is not impacted. What occurs is some entries are eliminated from the results. In our tests, when the hotel in the native ads position “survives” the filtering, it remains visible. When the filter leaves out the hotel, Booking.com reveals a different hotel, unless no participant in the bid satisfies the filtering requirements.

Up until now, Booking.com is testing native ads in the US as a point of supply (where the hotels lie) and as a point of sale (where the client lies). Simply put, only Americans reserving US hotels. It is expected that, if the outcomes are what Booking.com is anticipating, we may see the program broaden to more countries but the timeline is unclear.

When the user sorts the outcomes by any criteria, what happens is that the Native Advertisement disappears. It makes good sense as any ad that does not satisfy the arranging criteria would be a bad experience for the user.

What are the pros and cons for hotels?

With all these realities on the table, and waiting to have our own data and conclusions, we prepare for the following pros and cons for hotels:

Pros

What will take place if all hotels in an offered location get involved in native ads? Now lots of hotels in many locations are Genius so, where did the incrementality go? It may be various in Native advertisements, as more sophistication is needed so we could argue that not all hotels will get involved in the program.More intermediation.

If hotels use native advertisements solely to promote hotel deals over low-demand dates, ADR will naturally be lowerMore transparency and tracking. With the offered multipliers, hotels can shift demand to dates they have an interest in promoting.A “fairer” design as hotels just pay for the visibility that will eventually yield incremental sales, as opposed to commission boosters where hotels pay the exact same for all reservations (brand-new and existing). Especially when you compare it with commission boosters where hotels always pay the set commission, no matter what your rivals do.

Cons

How do you reconcile marketing on OTAs with increasing your direct sales?

At Mirai, we have actually always challenged the “value proposition” of OTAs. So why do we think Native advertisements work with a good direct sale technique? Here is our thinking:

There is no doubt that OTAs add value when they act as “gatekeepers,” helping users decide where to go and what hotel to choose. This gatekeeper function plays out high in the funnel where users are still going to lots of sites (Google, Tripadvisor, blogs) and apps (Instagram, Facebook, Pinterest). It is still a “share shift” video game and not a “channel shift” one. For hotels, it is incredibly hard and extremely costly to have an effect in this part of the funnel, unless you are Hilton or Marriott (and even they struggle). There are some efforts you can do (and need to attempt) such as “generic advertisements” (not branded) or Google Property Promotion Ads, however the effect is restricted. Booking.com Native ads play a function in this part of the funnel, so it is suitable with your direct sales strategy, and even complementary as long as you work hard to convert brand-new users into repeat and devoted customers.The “dark side” of OTAs, and where they include no worth whatsoever, is down the funnel where they compete head-to-head with the direct channel. Down the funnel the video game becomes a “channel shift” where there is little to no incrementality. We see some hotels bid on “top quality advertisements” (we approximated back in 2016 they represented 15% of their overall sales), metasearch and even natural listing in Google. Why should hotels pay those generous commissions to OTAs when the user was currently browsing for a specific hotel? The only answer is that they are required to, as OTAs have actually declined to go back from these placements, sending a worrying message to the market that their genuine value proposal to hotels is less as they declare.

As we see it, Native ads are a brave and clever relocation by Booking.com to give more choices for hoteliers to select from. In addition, it is the very first time we have seen Booking.com relocation in the direction of providing a more transparent and fairer marketplace where hotels pay more for incremental need and less for existing need. Its certainly not enough as the program must progress with more positionings and modifiers, however it is at least an initial step and distinguishes them from their rivals.

Conclusions

Smart hotels will be better positioned, as constantly, to benefit as they have actually the required know-how to choose in between commission boosters and Native advertisements depending on their requirements. As with all development and brand-new programs, the very first responsibility of hotels is to understand whats new. Would you pay 50% to get a new consumer who otherwise would have never stayed at your hotel?

Finally, we have two important remarks about Booking.com:

If the OTA does not send out a strong message and tracking tools to reveal that it is incremental, hotels may turn their backs on native ads.Its most significant danger is to prevent cannibalising existing visibility programs (chosen and commission boosters) by providing hotels a more transparent and fairer tool with incremental revenue-generation capacity. Doing so would eliminate the program, unless the OTA discovers the win-win circumstance where Booking.com gets more earnings and hotels capture more sales.

Find out more short articles from mirai

Native advertisements placement has the 2nd position scheduled, so hotels taking part (and winning the bid) would bypass all other hotels (other than the very first position) even if these hotels take part in the Preferred program or are applying commission boosters. When a getting involved hotel wins the bid and is currently naturally positioned first or 2nd in the outcomes, the ad is not shown (not even changed with another hotel). When the filter omits the hotel, Booking.com shows a different hotel, unless no participant in the quote fulfills the filtering requirements.

If hotels use native advertisements specifically to promote hotel deals over low-demand dates, ADR will naturally be lowerMore transparency and tracking. Why should hotels pay those generous commissions to OTAs when the user was already browsing for a specific hotel?