As we start a new year, lets recap what has taken place in our market considering that January 2020 and progress.

NB: This is an article from Beonprice, one of our Expert Partners

In the last 18 months we hoteliers have experienced something that never happened in the past, and this included the around the world lockdown during 2020. We can find all over that COVID-19 has badly hit the hospitality sector, but just how much precisely? Has it been the very same for all the sections? What is coming?

Sign up for our weekly newsletter and remain up to date

On the other hand, when we check the cancellations rate, we can see that it depends on the area:.

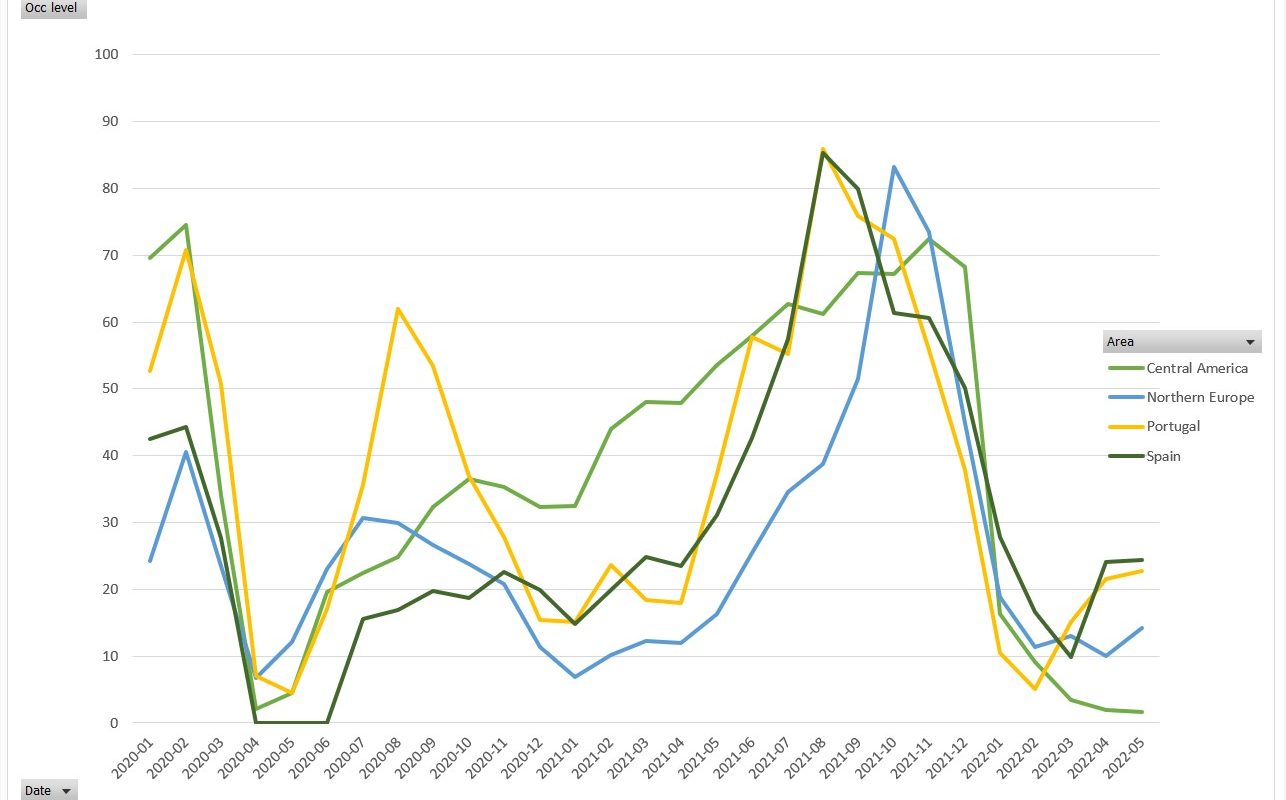

In Northern Europe, it has increased in the last months, reaching February 20 levels. This is due to the constant taking a trip limitations Central America and Portugal show an unfavorable pattern, and it continues until May 22. In Spain, we can see a worrying choice in April 2022, reaching November 21 levels.

As we evaluate business Mix for hotels in Central America we can see that throughout 2021 the company mix has actually been distributed as:.

Provided it is the start of a brand-new year, lets summarize what has actually occurred in our industry considering that January 2020 and work towards it. Evaluating the occupancy levels by geographical locations we can see that hotels are now at similar levels as they finished in January-February 2020, but the demand is being conservative in January 2022.

Central America.

As soon as we have evaluated the Occupancy and cancellations level, we need to question how our bookings are behaving, are we drawing in the best Business Mix?

80% of the overall has actually been transient.20% of the overall has been Groups.

Northern Europe.

Nevertheless, as we enter 2022, our OTB program that the voluntarily to take a trip of the Segments groups is a little greater than the previous year:.

Company Mix in hotels in Northern Europe show a consistent increase in Groups because Mid 2021. Hence, business mix during 2021 was:.

54% of the total was transient46% of the overall was Groups.

As we can see, the Spanish market is predominantly covered by short-term organization, nevertheless, Groups seem keen in April and May. As of the Transient segment, we can see that January has currently beaten January 2021.

Spain.

As a summary, business Mix in 2021 was as follows:.

This trend seems to continue in 2022, although it is too early to conclude.

12% of overall was Groups88% of overall was Transient.

Conclusion.

In the last 18 months we hoteliers have experienced something that never ever happened before, and this consisted of the worldwide lockdown during 2020. We can discover all over that COVID-19 has severely struck the hospitality sector, but how much precisely? Has it been the same for all the sectors? What is coming?

Clearly, during 2021 Transient was the dominant section in Portugal, reaching a 94% of overall of confirmed bookings.

As it is to anticipate, each market will show a different and unique business mix, but that is exactly the difficulty we like to get up every early morning, isnt it? Now, with this info in hand, I wonder if your hotel( s)s Business Mix remains in line with the marketplace need.

Lastly, lets evaluate the Portuguese market..

Portugal.

In Northern Europe, it has increased in the last months, reaching February 20 levels.

Check out more articles from Beonprice.

While 2022 is showing an increase demand on Groups, it is too early to conclude:.

We can quickly observe that January and February 2022 show a weaker trend than Last Year, however, the Segment Groups seems to be getting more powerful this year.

For the next 5 months, we can see that Transient is coming slower than Groups, as Groups is as of today the 33% of the company mix.