2020 is a year that the automobile leasing market would wish to forget. The pandemic and the obstacles it brought in regards to lockdowns and social distancing had the industry witnessing an unmatched slump. With the development of the Covid-19 vaccine, demand for car leasings is now slowly choosing up.

With the US speeding up vaccination efforts combined with the ease in travel constraints, we are seeing a spike in travel activity throughout the US and North American markets. There is an increased demand for domestic journeys, getaway leasings, and staycations, with numerous individuals going with interstate travel. By analyzing the patterns of the previous couple of months, profits supervisors can successfully plan much better earnings techniques for forecasted need.

Cars and truck rental need saw a rise in the majority of the cities in the US and Canada We are seeing higher pricing developing out of lesser supply, stimulated by the fleet and car inventory scarcity. This causes inescapable cost volatility, which is tough to prepare and anticipate for without advanced analysis and pricing automation.

How is Summer Looking for Car Rentals?

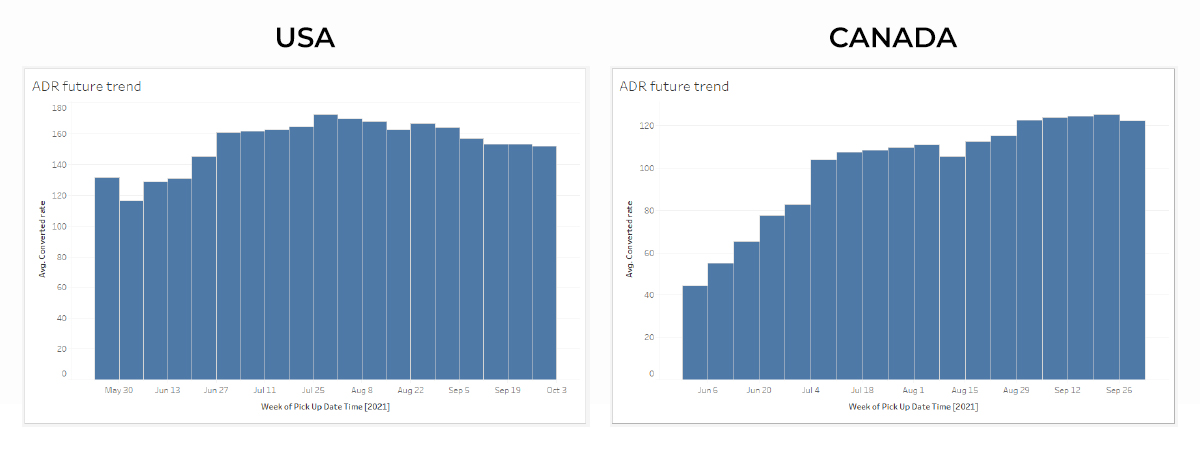

Prices for summertime rentals look more pricey in the US, with an average of 20-30% boost in the rates for everyday ADRs. Nevertheless, Canada is following a more linear development course for ADR prices.

Most of the areas in the United States have plateaued and settled down on prices that is somewhat aggressive compared to Canada and other locations. Summer season demand appears to have peaked in the United States, with averages of around 180 dollars on ADR, greater than the peak in Aug 2019. Comparatively, the summer season need isnt yet getting that sharp spike in Canada.

With this rising demand, rental companies are trying to optimize their incomes through a fleet size comparable to previous years. This has led to aggregated utilization of over 95% in the leading 25 locations of the US market. The general utilization calendar is around 70% and looks poised to continue that method unless the market collectively takes corrective steps.

It would be fascinating to see how income managers try and discover methods to increase the profits based upon demand for the pre-existing fleet. To much better comprehend pricing factors, we require to analyze automobile rental rate variations based on place and cars and truck type.

The last-minute rates for Canada are substantially low when compared to the further out dates, which have costs on the greater side. For the US, however, the last-minute rates are way greater, across all pickup dates spread out over 4 months up unto October.

Volatile Locations Across the United States and Canada.

Cars And Truck Rental Trends on the US East Coast

Akin to the national trend, the costs in Newark, EWR, and New York, JFK witnessed an increase as the reservation date approached, followed by a two-week dip, which then supported for a 3– 4-month period.

In Canada, the intermediate and full-size vehicle sectors proved to be the most vibrant classification compared to other segments. This is rather similar to the US market, for the very same factors of pandemic-driven supply chain disruptions and component shortages.

Utilizing CarGain Canvas to your Advantage

CarGain Canvas, among RateGains most current offerings is helping Car Rental business fix their rates obstacles by assisting them act rather of analysis. CarGain Canvas is an integrated analytics platform that allows smart rates decisions by providing a 360-degree market view on rates and other KPIs.

Canvas functions several rates tools developed to cut losses and enhance revenues. Updated competitor information is available in real-time on the control panel, enabling you to compare and price your item offerings smartly.

To stay competitive you can now process Insights on car type, competition, area, mileage, and LOR to see every opportunity available in the market and imagine them in charts, tables, or the simple to understand calendar view, assisting you determine price variations easily.

Ultimately, CarGain Canvas assists you identify-verify-rectify the loopholes in your rates method.

Canvas is an essential for earnings managers and automobile rental firms to set price points that optimize their earnings no matter the market conditions. Do not lose a single chance to transform this summertime with CarGain Canvas

There has actually been no rise in demand for cars and truck rentals as with the healing in the United States, revenue supervisors in Canada have actually adapted by framing their rates techniques based on the area.

Edmonton, YEG, Victoria, YYJ, Calgary, YYC, and Vancouver, YVR have actually mainly followed the same trend with an ADR of around 100 dollars a day. Toronto, YYZ, however, has shown a lot of rate volatility with costs decreasing significantly closer to the booking dates and peaking out at around 2 months with approximately close to 250 dollars.

The total market outlook in Canada leans towards decreased costs more detailed to the booking date. Prices volatility and uncertain need pose an obstacle for income supervisors and vehicle rental operators while pricing the far-out dates, on whether to price it higher or at a variety comparable to the lower rates closer to the booking date. For June, car leasing prices look 20% cheaper when compared to the exact same timeframe in 2015.

Vehicle Rental Pricing Insights for other marketsRateGain has actually collected a similar list of such statistics and insights for other markets also, which we would more than happy to share with our clients. Contact us by means of email or require more information on how you can come aboard with us.

Which Car Categories must you Focus on

It is impractical to arrive at a prices decision based solely on the rate insights of a given place. Income supervisors require to think about the type of car leased, as rates usually varies across the different car categories. Here are some market insights based on vehicle types that must help vehicle rental companies set up much better prices points.

About the Author

Rasika Kumar Vice President– Sales Account ManagementRateGain

In her function, Rasika Kumar leads the Account Management group at RateGain for travel sales. She is an ingenious problem solver with an exceptional eye on details, handles the portfolio of consumers across the travel section, and makes certain to attain long-term success.

She has more than 12+ years of diverse experience in consulting and leading various roles in travel companies and proficiency in preserving and broadening relations with existing clients.

With the development of the Covid-19 vaccine, demand for car rentals is now slowly picking up.

Pricing volatility and unsure need present a challenge for earnings supervisors and cars and truck rental operators while pricing the far-out dates, on whether to price it greater or at a variety comparable to the lower rates closer to the booking date. For June, cars and truck rental rates look 20% less expensive when compared to the exact same timeframe last year.

Income managers require to consider the type of car rented out, as pricing most frequently varies across the various vehicle categories. Here are some market insights based on automobile types that ought to assist cars and truck rental companies set up much better pricing points.

In the Florida area, Miami, MIA had a few summer season dates with big spikes, with on-demand prices crossing 160 dollars as ADR. Overall, Miami, MIA, Orlando, MCO, and Tampa, TPA revealed different prices methods for both long-lasting and days closer to the reservation date.

Car Rental Trends for Top Cities in Canada

Owing to the pandemic, the shortage in supply of electronic chips for full-size and intermediate cars resulted in lower cars and truck availability in this sector. This led to a boost in prices to 300-350 dollars a day, almost 30% higher than what was experienced in 2015 in the United States.

Vehicle Rental Pricing Trends in Canada based on Car Categories

Atlanta, ATL, and Boston, BOS had a different photo to show, with revenue managers choosing fixed prices for future dates, due to the lower yield from demand.

Cars And Truck Rental Trends on the US West Coast

Surprisingly on the West Coast, essential cities Los Angeles, LAX, Las Vegas, LAS, and San Francisco, SFC kept the cost flag on the higher side, with San Francisco selecting a 25% greater rate flag compared to LAX and LAS.