We have actually just recently launched our first BenchDirect Insights Report, a global direct channel efficiency report with the objective of sharing the current direct channel patterns that have been observed within BenchDirect, our brand-new benchmarking platform for hotels.

NB: This is a post from The Hotels Network, one of our Expert Partners

In this article, we will focus on the direct booking scene for the Asia-Pacific (APAC) region, comparing the efficiency of hotels in South East Asia with those in Australasia. To offer a clear understanding of what the current direct channel scene appears like in this region, the analysis looks at Q2 versus Q1 efficiency in 2021 and covers the primary hotel direct reservation metrics including website traffic, conversion rates, variations, and visitor profile.

Subscribe to our weekly newsletter and keep up to date

In the complete report, 8 other areas have been included: Middle East & & Africa, Eastern Europe, Latin America, North America, Western Europe, Mexico & & Caribbean, Northern Europe and Southern Europe. Click here to check out the full analysis.

Lets take a look below at what the insights reveal about the direct channel trends for the APAC area in 2021.

1. Website Traffic Evolution: Unique Visitors

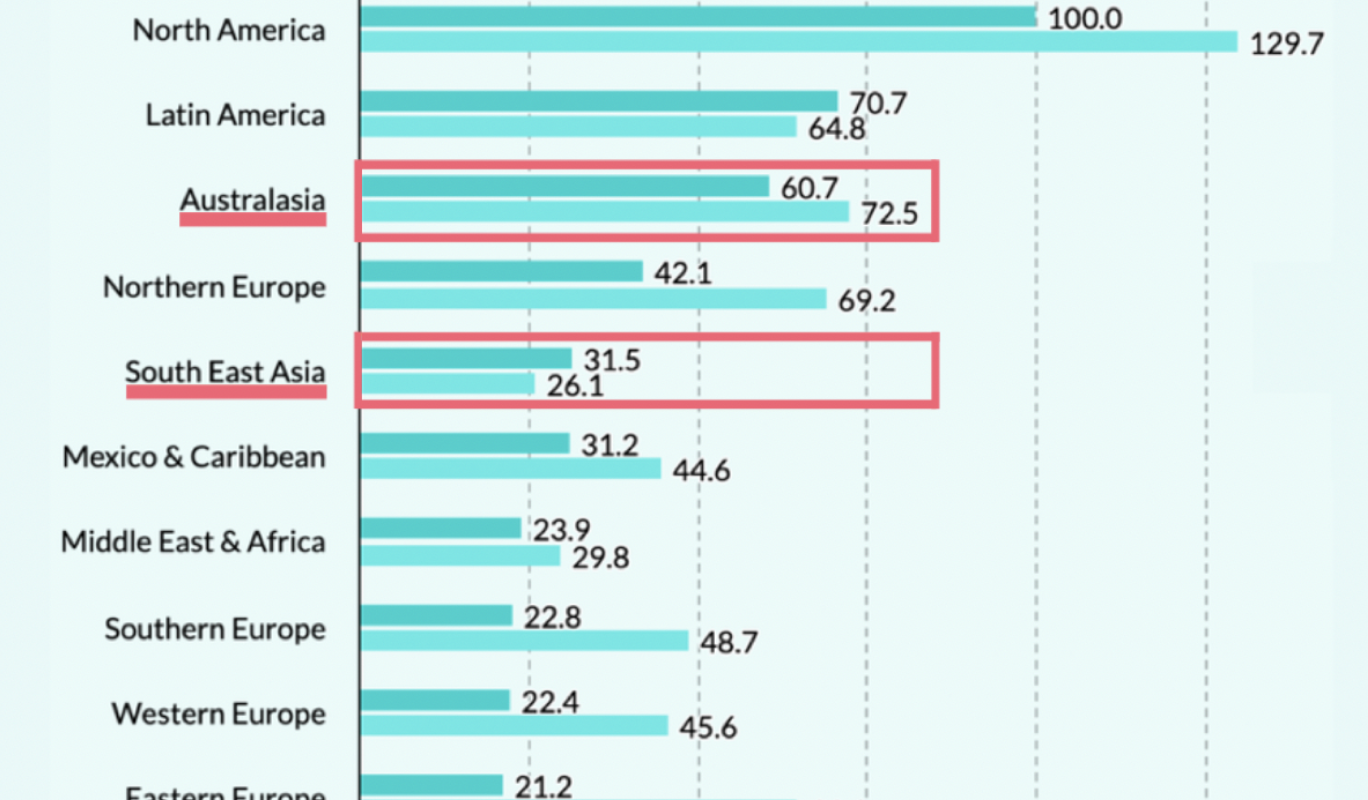

In terms of site traffic, the analysis compares the mean number of special visitors per hotel room landing on hotel websites in Q2 versus Q1 2021, with areas indexed to North America in Q1 set at 100. The outcomes indicate that the volume of distinct visitors increased in Q2 vs Q1 2021 in Australasia whereas it reduced in South East Asia.

2. Conversion Rate Evolution: Total Conversion & & BE to Booking Conversion

Breaking down the conversion rate at various stages in the booking funnel, it is possible to better understand the chauffeurs of these outcomes. In Australasia, conversion rates decreased somewhat throughout the funnel in Q2. The reduction in Q2 in South East Asia, nevertheless, was plainly driven by a decrease in the Booking Engine to Bookings conversion rate, which plummeted by more than 20%..

Total conversion rate is the portion of overall distinct site visitors who made a reservation. Hotels in Australasia had among the greatest site conversion rates in Q2 whereas the rates were extremely low in South East Asia. Despite efficiency improving in many regions in Q2 vs Q1 2021, in both Australasia and South East Asia total conversion rate reduced during this period.

By having the ability to identify precisely where in the scheduling funnel hotels are underperforming, hotels are better able to focus their efforts on making modifications where they will have the most effect. Hotels in South East Asia have a chance to improve the user experience within the booking engine in order to drive more direct reservations in Q3 & & Q4 2021.

3. Variations advancement: Frequency & & Amount

. For price disparities from OTAs, the analysis looks both at Frequency, how frequently a variation takes place, and Amount, by just how much the rate is undercut.

South East Asia had the greatest rating in terms of variations Amount with 12.9%, this is not so significant as the variations Frequency of this area is one of the lowest. It is fascinating to note, nevertheless, that the rate disparities in the area occurred regularly in Q2 than in Q1 2021.

Australasia experienced the highest jump in Frequency of disparities, going from the most affordable rate in Q1 to 17.8% in Q2 (+63%). Drilling down on the data, it can be seen that this shift was mainly due to a significant increase in the Frequency of variations on Hotels.com.

4. Visitor Profile evolution: Top 10 International Source Markets.

Looking at the charts, a comparable pattern can be seen for both South East Asia and Australasia, with the United States as the biggest worldwide source market without a doubt. The portion of site traffic coming from the United Kingdom decreased in both markets in Q2..

Throughout the pandemic, international travel has been seriously limited, which was shown in the results of this research study. The percentage of global traffic to hotel websites was really low for both South East Asia and Australasia. Some favorable indications of healing were visible with a small boost in worldwide site traffic in Q2, most likely due to the relaxation of specific travel constraints in these regions..

The charts above show the Top 10 International Source markets for hotel website traffic. The X axis is the % of visitors from each source market in Q2 and the Y axis is the % of change vs Q1 for each of these markets..

5. Visitor Profile advancement: Booking Window & & Length of Stay

Taking a look at the chart, there is no apparent correlation between the booking window and hotel length of stay. In both Australasia and South East Asia, the booking window was shorter than in the bulk of other regions and it decreased further in Q2, indicating that more travellers were waiting to the eleventh hour before validating a booking. Hoteliers in these regions can consider promoting last-minute packages on their site to maximize these bookings however also try to secure more bookings ahead of time by offering early-bird promos..

Understanding your hotels performance compared to the market should be a vital part of your direct channel growth strategy, and BenchDirect provides you simply that. Our brand-new and FREE (yes, its totally free permanently!) benchmarking tool offers any hotel with insights about their direct channel efficiency compared to the marketplace and competitors.

.

These are simply some of the insights that can be found in our BenchDirect Insights Report. A full analysis consisting of more regions and metrics is included in the report. Click on this link to check out the complete analysis.

In current advancements, there has actually been some relaxation of travel limitations in APAC, making it much easier for travelers from other countries to go into. For example, in Thailand, quarantine upon getting here in Bangkok has been lowered from 15 to 7 days and is set to be gotten rid of entirely from November 1st. The Phuket Sandbox program is enabling immunized foreign tourists to visit Phuket without quarantining.

In both Australasia and South East Asia, the reservation window was shorter than in the bulk of other regions and it reduced further in Q2, showing that more tourists were waiting to the last minute before confirming a reservation. Australasia increased their volume of special site visitors in Q2 vs Q1 2021 whereas the volume decreased in South East Asia.Total site conversion rates decreased in both Australasia and South East Asia in Q2 vs Q1 2021. In APAC, there was a minor healing in the percentage of website traffic coming from international markets in Q2.In both South East Asia and Australasia, the United States was the leading global source market in Q2.Booking windows decreased further in Q2 2021 in both South East Asia and Australasia.

Find out more short articles from The Hotels Network.

Hotels in Australasia had one of the greatest website conversion rates in Q2 whereas the rates were very low in South East Asia. Regardless of efficiency enhancing in many regions in Q2 vs Q1 2021, in both Australasia and South East Asia total conversion rate reduced throughout this duration.

As border limitations begin to slowly alleviate across APAC, hotels in the region can take advantage of this chance to launch projects to attract foreign visitors and regain their reasonable share of the worldwide travel market.

Secret Takeaways.

Australasia increased their volume of unique site visitors in Q2 vs Q1 2021 whereas the volume decreased in South East Asia.Total website conversion rates decreased in both Australasia and South East Asia in Q2 vs Q1 2021. Compared to other areas internationally, Australasia experienced the highest dive in Frequency of price variations, going from the area with the most affordable rate in Q1 to 17.8% in Q2 2021. In APAC, there was a slight healing in the portion of site traffic originating from worldwide markets in Q2.In both South East Asia and Australasia, the United States was the leading international source market in Q2.Booking windows reduced further in Q2 2021 in both South East Asia and Australasia.

Singapore also started reopening borders in early September, establishing quarantine-free travel for fully-vaccinated visitors from Germany and Brunei. According to the countrys transport minister S. Iswaran, Singapore is actively dealing with a number of nations to develop travel lanes to further open its borders in the coming weeks and months.

In terms of Length of Stay, both Australasia and South East Asia had a relatively short Length of Stay compared to other regions but there was an improvement of around 5% in Q2 vs Q1. There is a clear chance for hotels in APAC to motivate visitors to stay for longer at their residential or commercial properties by offering incentives and promoting longer remain on their website.